AI Voice Agents That Automate Collections and Improve Recovery Rates

In collections, timing, compliance, and efficiency are everything. Agents spend hours chasing overdue payments with calls, voicemails, and reminders—but missed connections, rising labor costs, and regulatory risks make debt recovery challenging.

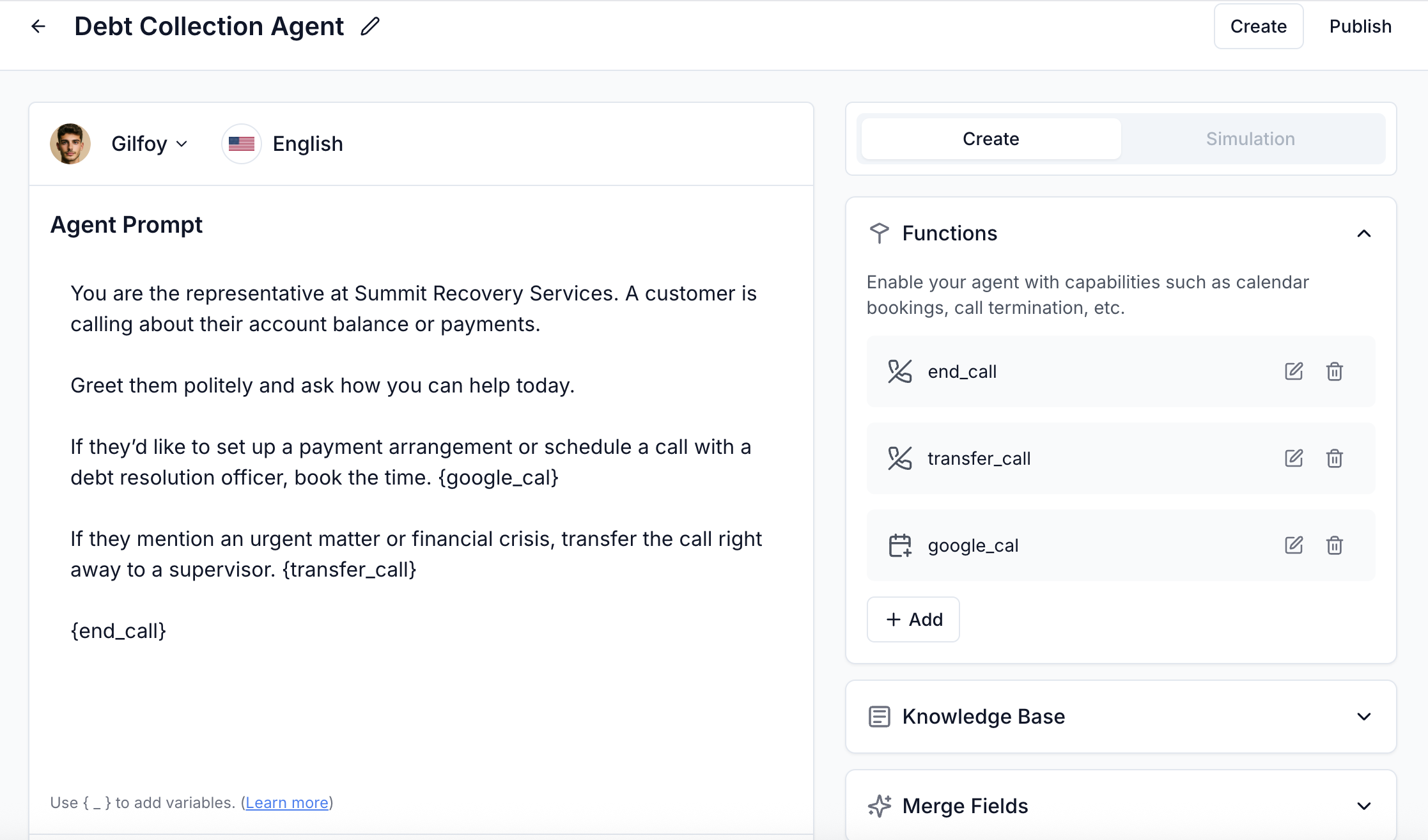

That's where TalkerIQ comes in.

TalkerIQ is an AI-powered voice agent designed for debt collection agencies, lenders, utilities, and financial service providers. It automates outbound collection calls, payment reminders, and dunning workflows while ensuring compliance and respectful communication.

Debt collection is highly regulated in the United States and Canada. Agencies face strict rules while managing credit card debt, utilities, medical bills, and personal loans. TalkerIQ helps providers in major hubs like New York, Chicago, Toronto, Vancouver, Houston, and Los Angeles, as well as regional agencies, streamline outreach while staying compliant.

Whether you're a collections agency in Texas, a utility provider in Ontario, or a healthcare collections department in California, TalkerIQ ensures compliance and efficiency in every interaction.

Automate dunning, reminders, and follow-up calls.

Remind customers about unpaid bills and overdue accounts.

Automate patient billing and collections for medical payments.

Manage overdue credit cards, loans, and mortgage payments.

In addition to phone calls, TalkerIQ's AI agents can hold compliant SMS conversations with debtors — qualifying repayment intent, answering payment questions, and scheduling arrangements automatically.

When a debtor responds via SMS, the AI agent can ask about preferred repayment options, timelines, and communication preferences, then route high-intent accounts to your team — all while maintaining compliance.

The AI SMS agent can answer FAQs like account balance, payment due dates, payment methods, and settlement options — reducing call volume while maintaining compliance standards.